Greenbrier County Assessor’s Office

Joe Darnell, Greenbrier County Assessor

Joe Darnell, Greenbrier County Assessor

jdarnell@assessor.state.wv.us

912 Court Street North, Lewisburg, WV 24901

The County Assessor is an elected office with a term of 4 years. The assessor’s primary responsibility is the appraisal of real estate and personal property, and the management of tasks associated with county taxes.

All property shall be appraised annually as of the first day of July at its true and actual value. The assessor shall obtain from every person who is liable to assessment a full and correct description of all personal property. Assessors are required to visit all real estate at least once every three years but all property is to be at market value on an annual basis. The assessor shall finish the work of assessment and complete the land and personal property books not later than the 30th day of January.

Land and personal property books are to be completed in time to submit to the Board of Equalization and Review no later than the first day of February of that assessment year. The assessor and assistants shall attend the Board of Equalization and Review and render any possible assistance in connection with the valuation of property.

The assessor shall annually, not later than the third day of March, furnish to the Recorder or Clerk of Cities and Towns, Secretary to the Board of Education, State Board of Education, and the County Commission, along with Public Utilities, certification of the assessed values for the current year. The levying bodies are required to use these values to prepare their budget estimates and lay the levies. Once levy rates are certified to the Auditor, they are certified to the Assessor and are entered into the computer to allow the Sheriff to print tax tickets. Assessors determine values and in turn, the levies set by levying bodies, including excess levies, determine tax revenue.

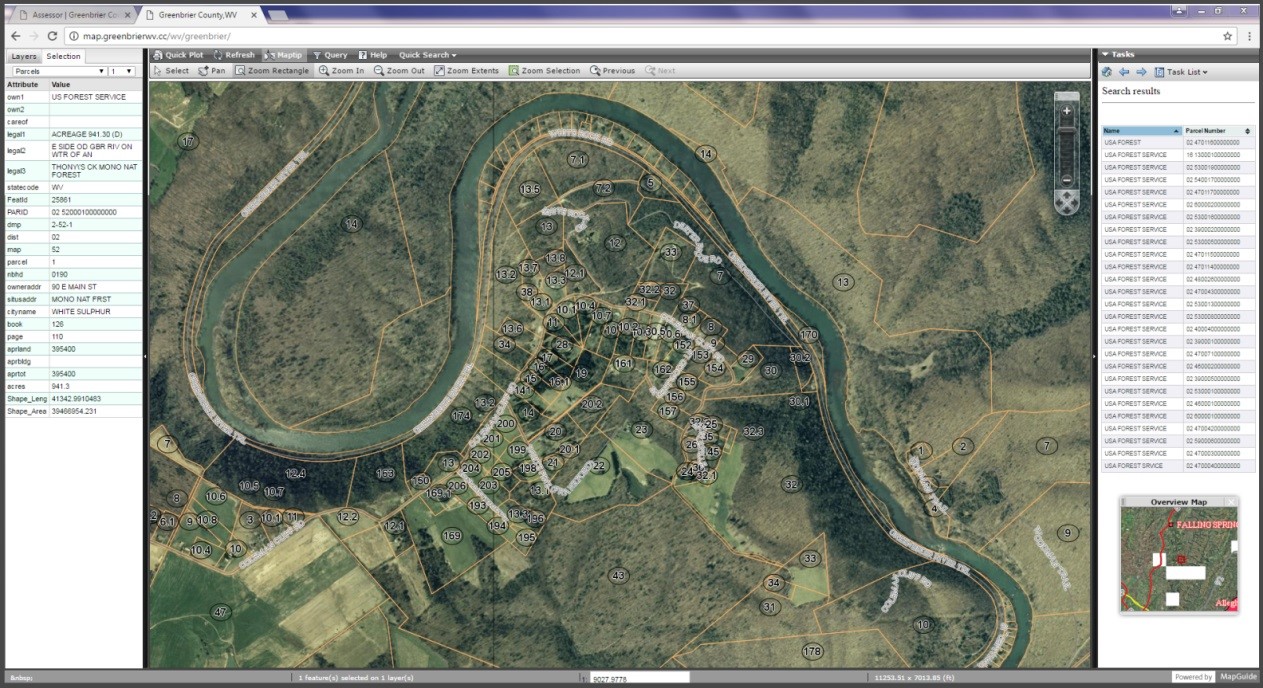

Interactive Tax Map and Property Search

Search Parcels by Parcel ID, Owner and Address.

View and Print Maps containing Greenbrier County parcels, roads, hydrography, soils and aerial imagery. View parcel’s Parcel ID, Owner, legal description, neighborhood, deed book and page, appraised land value, appraised building value and appraised total by clicking on the parcel with the select tool. To measure area or distance use the Measure feature in the Task List drop down menu on the upper right corner.

For additional Mapping or GIS information please contact:

Tonya Brown-Head of GIS Mapping

email

304-647-6645

Or

Debbie Bowman-GIS Coordinator

email

304-647-6659

Click on the banner below to view and pay tax bills through the Greenbrier County Sherriff’s Tax Office.

Homestead Exemption

If you are 65 years or older, or are permanently and totally disabled, you may file for Homestead Exemption. Homestead Exemption allows for a $20,000 exemption of the assessed value of owner-occupied property. The applicant must have occupied the property for more than six months prior to the date of application and have been a resident of West Virginia for the two consecutive tax years prior to the tax year of application. Homestead Exemption is continuous, meaning the eligible taxpayer does not need to reapply every year, unless for a mobile home classified as personal property. Proof of age or proof of permanent and total disability are required. Homestead Exemption forms are available online or in the Assessor’s Office and are due December 1.

Homestead/Disability Exemption Form (PDF) (Must be signed and submitted with proof of age or total permanent disability.)

Farm Use Vehicles

West Virginia State law provides that farmers may drive farm use vehicles on the highway. These farm use vehicles do not have to be licensed but the following provisions must be met:

- The vehicle may be only used on the highway for agricultural purposes and only from one farm, which is owned or leased by the vehicle owner, to another farm, regardless of whether or not the tracts adjoin. Provided the distance between the tracts not exceed 25 miles, or for the purpose of taking it or other fixtures attached, to and from a repair shop for repairs. This exemption also applies to any trailer attached to such a vehicle.

These vehicles may also be used to take agricultural products to market providing the distance does not exceed 25 miles and such use is seasonal. - These vehicles may only be used on the highway between sunrise and sunset.

- The vehicle must have the words “FARM USE” affixed to both sides in ten inch letters.

- Any vehicle which would be subject to registration as a Class A or Class B vehicle, if not exempt, must display a farm use exemption certificate on the lower driver’s side of the windshield.

This exemption certificate sticker must be obtained annually, September 1, from the assessor for a two dollar fee. - The vehicle must be road safe.

- The vehicle must be covered by insurance.

Taken from West Virginia Farm Bureau NEWS.

July 15– Sherriff required to mail all tax tickets by.

September 1– First half taxes are due to the Sheriff’s Tax Office to receive the 2.5% discount.

September 1– Managed Timberland applications are due to the State Tax Department.

October 1– Personal Property Assessment returns are due in the Assessor’s Office.

September 1– Farm Status Valuations are due in the Assessor’s Office.

September 1– Business/Commercial Personal Property Assessment returns are due in the Assessor’s Office.

December 1– Homestead Exemption applications are due.

January 31– Appeals to Assessor on value must be completed. Dates set for Board of Equalization and Review.

February– Board of Equalization and Review meets to hear appeals of value. Appointments are required.

March 1– Second half of taxes are due to the Sheriff’s Tax Office to receive 2.5% discount.

April 30– Last day to pay taxes without penalty.[/text_output]

The following forms are provided for your convenience in a user fillable Adobe Acrobat format (.pdf).

Change of Address Form (PDF)

Commercial Business Property Return Form (PDF)

Dog License Form (PDF) (Appropriate payment must be submitted with form.) or pay online here

Homestead/Disability Exemption Form (PDF) (Must be signed and submitted with proof of age or total permanent disability.)

Farm Use Valuation Form (PDF)

Personal Property and Real Estate Assessment Form

Mobile Home Assessment Form (PDF)

Commercial Business 2022 Trend and Precent Good Tables

Commercial Business Car Inventory Worksheet

Commercial Business Itemized Vehicle Report Worksheet

Commercial Business Vehicle, Motorboat, and Farm Equipment Dealer’s Inventory Worksheet

Commercial Returns

Submit Forms in Person to:

Joe Darnell

Greenbrier County Assessor

912 Court Street North

Lewisburg, WV 24901

Submit Forms Via U.S. Mail:

Joe Darnell

Greenbrier County Assessor

P.O. Box 881

Lewisburg, WV 24901

Submit Forms Via Email to: scrooks@assessor.state.wv.us

Submit Forms Via Fax to: 304-647-6667

Questions: 304-647-6615

Property taxes can now be paid online with a credit or debit card. There will be a processing fee of 2.95% (minimum $2.00) that will be charges in addition to the tax amount. This fee is charged by the credit card processor. Taxes may be paid at WV Property Taxes . If you have any questions to problems, please contact the Chief Tax Deputy at 304-647-6610. Beginning October 23, 2013, delinquent real estate taxes must be paid by cashier check, money order, certified check or United States currency. Credit card payments for 2012 real estate taxes will not be accepted, either online, by phone, or in person.